Ceylon Electricity Board Contributed Immensely for the Promotion of Solar Power in Sri Lanka

By Eng. Lanka Perera and Eng. Rohan SeneviratneThis article was initially published in Ceylon Today Newspaper dated 12 th June 2021.

Sri Lanka, being an island situated near the equator, is blessed with a significant amount of solar radiation or sunlight, to be put in plain terms, throughout the country, year-round. Looking at this fact and the rapid developments in solar technology, many individuals claim that solar power generation would be Sri Lanka’s best option to achieve its goals of lowcarbon electricity generation and providing low-cost electricity to the people, in light of the pressing need to meet the growing demand.

And, there has always been an uproar regarding relevant authorities and professionals either turning a blind eye towards this solar potential lying in front of us or purposely trying to add friction to an otherwise smooth journey of popularising this green energy source, delivered free at our doorstep. In particular, Ceylon Electricity Board (CEB) being the major electricity utility in SL is blamed time and time again for hindering the progression of solar industry. Whether these accusations are based on facts or are mere misconceptions needs to be explored further.

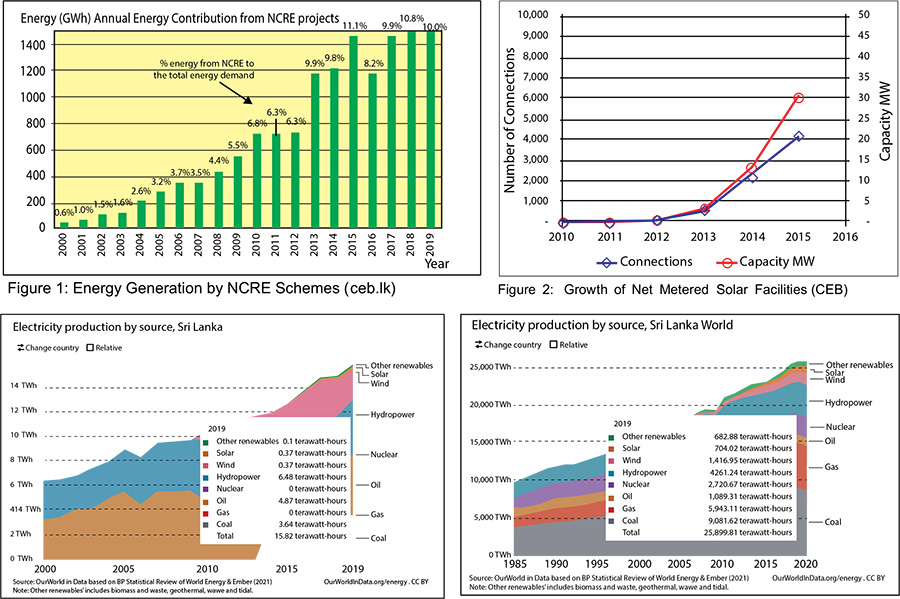

In this context, it is worthwhile looking through the path of progression of solar industry in SL, especially CEB’s contribution to date and what is in store for its future. Up to 1999, over 50% of electricity generation was fulfilled by renewable energy, which mainly consisted of large hydropower generation. Meanwhile, in 1996, embedded generators were interconnected to CEB’s distribution network, under power purchase agreements. Grid interconnection of Non-Conventional Renewable Energy (NCRE) generation plants of up to 10 MW was initiated this year. Under NCRE umbrella, renewable energy sources like mini-hydro, solar, biomass (community waste, dendro) and wind are considered. As a progressive step, in 1997 CEB introduced the grid interconnection standards and procedures for embedded generators.

Owing to technical constraints at that time, CEB did not allow connections of renewable energy facilities to the low voltage system. Another favourable step to NCRE developers including solar projects, was the introduction of a cost-based, technology-specific and three-tier tariff from 2007. This allowed a project developer to cover its operation and maintenance and capital costs and it ensured an assured return on capital.

From the inception in 1996, the NCRE sector in SL has gradually evolved and annual energy contribution by NCRE was continually on the rise. 2008 marked another milestone in the path of renewable energy sector in SL, as Cabinet approved the Net Metering concept. This opened doors for the utilities’ bulk and ordinary customers alike, to connect a renewable energy source to the low-voltage network.

To allow for implementation of net energy metering scheme, the ‘Grid Interconnection Standards for Net Metering of on Grid Renewable Energy Based Generating Facility’ was formulated and published in 2010, in which CEB was a pioneer. That year, CEB formulated and published the ‘Net Energy Metering Manual.’ The allowable size of a facility started with 42 kW and was then enhanced to 10 MW and later on reduced to 1,000 kW.

The scheme came into effect from July 2010. In this scheme, no payment was made to the customer. The energy consumption (import) and the energy fed (export) to the network were set off against each other.

Any excess generation was carried forward up to 10 years and any excess usage was billed at normal tariff. Even though this scheme was not limited to solar and any renewable source could be connected, customers predominantly consisted of solar facilities. With the passing years, the solar market constantly evolved. By 2016, the Net Metered solar customer base of CEB had grown to 4,690 and that of Lanka Electricity Company (Pvt) Ltd (LECO) had reached 1,795.

Capacity wise, 32 MW had been added to the system via Net Metered solar generation by 2016. The average size of a connected solar installation was approximately 5 kW. The solar market was gaining momentum, when in 2016 another progressive step in the Net Metering scheme was introduced. The new additions to the scheme were introduced specifically for solar connections. The expanded concept consisted of three schemes, NetMetering, Net Accounting and Net Plus.

The Net Metering scheme was retained, with option for existing customers to shift to another scheme. Net Accounting and Net Plus Schemes were allowed for power producers using solar energy and installations necessarily had to be on actual functional roofs and not on ground or structures erected for the purpose of adding more solar capacity.

These schemes also included payments for energy fed to the network by the customer, unlike in the initial scheme. Under the Net Accounting scheme, customer’s consumption and solar generation were set off against each other and a payment was made for excess generation at the introduced export tariff, of Rs 22 per unit during the first seven years and from the eighth year up to twentieth year, Rs 15.50 per unit. The contract period was extended to 20 years.

Net Plus scheme accounted for energy consumption and generation separately. The generation from solar PV plant was directly exported to the network and the customer was paid as per the introduced export tariff, same as in Net Accounting. Customer’s total consumption was billed at the normal tariff. The export tariff is Rs 22 per unit during the first seven years and from the eighth year up to twentieth year, Rs 15.50 per unit. Contract period was extended to 20 years. The capacity of the solar installation was extended to contract demand of the roof owner.

The above prices were so attractive to the solar developers and less favourable to CEB, as CEB average selling price to the customers is about Rs 16.50. Favourable export tariff for customers, added to the growth of rooftop solar industry, while the utility incurred additional expenditure in implementing these schemes. Despite this, CEB spearheaded in establishing standards and procedures related to provision of these schemes and proactively took actions to promote these schemes by enlightening customers, fast-tracking service providing procedures, and effecting payments to customers.

In 2016, almost immediate to the introduction of the Net Plus schemes, the Ministry of Power and Energy, launched a project called “Soorya Bala Sangramaya” in collaboration with CEB, Sustainable Energy Authority (SLSEA), and LECO, to promote rooftop solar plants. Then target was to add 200 MW by solar generation to the national grid by 2020 and 1,000 MW by 2025.

With the relentless work of CEB and contributions of all stakeholders in the rooftop solar industry, by 2017, within one year of launching the project, total solar capacity increased from 30 MW to 100 MW. Further, in 2017, CEB developed the procedure to absorb HT Metering customers under Net Plus scheme, with capacities of 1 MVA or above.

In this, the procedure and technical requirement for connection of High-Tension metering consumers under Net Plus Scheme, Procedure on commissioning and testing of solar installations connected to low-voltage feeders and recommendation for tariff for the HT metering solar installations were formulated.

At end April 2021, SL has 32,411 roof solar installations with total capacity of 367 MW. Out of the above, 16,472 are installations (121 MW) operate as Net Metering scheme, 14,392 installations (113.5 MW) operate on Net Accounting scheme, and another 1,547 installations (132 MW) operate on Net Plus scheme. Overvoltage issues at low-voltage network in the daytime is becoming quite a common problem in urban areas, where the locations have a higher amount of rooftop Solar PVs installed.

Electricity flows from higher voltage to lower voltage. The inverter has to be running at a higher voltage than the grid, so it can push power out. On a sunny day, when a household’s generation exceeds its consumption, the solar inverter pushes electricity into the grid and this lifts the network voltage slightly, depending on the distance from the transformer. The problem occurs when a large number of solar PV installations are connected to the same low-voltage line and every solar installation pushes power into the system.

This lifts the network voltage above the regulatory limits. This can cause damage to sensitive electrical equipment connected to the network. Voltage rise amount caused by Solar PV increases when the distance from the distribution transformer increases. It is nearly impossible to connect Solar PV systems which are to be connected at far end locations from the distribution transformers without violating voltage limits.

Thereby, it is quite obvious that there is an upper cap of domestic solar PV systems which can be absorbed to low-voltage networks. From 2017 onwards, CEB initiated tenders to procure energy from groundmounted Solar PV Power Plants. The initiated ground-mounted Solar PV Power Plant tenders are in the form of 1 MW x 60 plants, 10 MW x 2 plants, 1 MW x 90 plants, 10 MW Solar PV Power Plant with Agriculture Farming and 150 MW Solar PV Power Plants in (1-10) MW capacity and the total expected capacity of those initiated tenders are about 330 MW. At present, 33 nos. of Solar PV Power Plants amounting to 33 MW capacity have been connected to the national grid and about 59 Solar PV Power Plants amounting to 77 MW capacity, having signed the Power Purchase Agreement with CEB are in construction stage and it is expected to be commissioned within the next 12-15 months. The balance capacity is expected to be connected to the national grid in the next 2 years.

Further, CEB expects to initiate another 90 MW ground-mounted Solar PV Power Plant tender in (1-10) MW capacity and 60 MW ground-mounted Solar PV Power Plant tender in 10 MW capacity during the upcoming months to further bolster the renewable energy integration to the national grid. At present, the installed capacity of ground-based solar installations is 84 MW.

Over the years, while rooftop solar energy generation has continually grown, CEB diversified its solar arena in 2020 by launching a project to implement 7,000 nos. of 75 kW groundbased solar PV generating systems, under Build-Own-Operate (BOT), near distribution transformers in rural areas, under National Competitive Bidding.

The distribution transformers where the solar facilities are to be connected have been identified by CEB, after a technical study. Solar facility implementers are to be selected via a competitive bidding process and the bid has been published. The project is expected to add 525 MW of solar power to the national grid and contribute 1,000 GWh of electrical energy per year to the country. Further, CEB will financially benefit, since the tariff for the solar energy will be decided via competitive bidding (approximately Rs 16 per unit) and also this will contribute to CEBs goal to achieve 70% electricity generation via clean energy sources by 2030.

In this course of progression, CEB has constantly evolved in establishing standards, developing technical specifications, testing procedures and in human capacity-building in the solar sector.

Also, in parallel, the other industry stakeholders have grown, with time. More and more solar PV vendors have come into the market and with the ever-growing competition, vendors have improved their technical know-how. Further, the standards of equipment such as solar panels, inverters, battery banks and other associated equipment, the workmanship, and the value-added services provided, such as online energy monitoring systems have improved.

Not to mention the existing and prospective solar customers have become more knowledgeable and keen in this area. Utilities, private solar vendors and customers all alike have become more vigilant to the varying solar market conditions in the technical as well as in the financial sense.

Regardless of these continuous improvements and contributions by CEB to promote renewable energy, critics have always pointed out that SL is on a slow drive and CEB is an impediment for promotion of solar and SL should meet major percentage of increasing electricity demand by renewable energy resources. Yet, despite abundance of resources like wind and solar, the possibility of a 100% renewable fed system needs to be analysed, giving due consideration to technical and financial constraints.

SL has so far tapped the full potential of major hydro schemes and is left with only NCRE resources like mini-hydro, wind, solar, bio-mass for any new renewable additions. Resources like wind and solar are inherently intermittent and their output fluctuates according to the real-time availability of wind and sunlight.

This adversely affects balancing supply and demand of the power system and its stability. Also, it in turn requires either adequate reliable generation reserve from other resources or enough energy storage connected to the system to compensate for the fluctuating supply and to maintain system stability.

Additional financial burden has to be borne to upgrade the existing transmission and distribution networks to smart grids to support the high penetration of renewable sources like wind and solar. As per CEB Least Cost Generation Plan, it is envisaged to generate 70% of electrical energy requirements through clean energy sources by 2030, out of which 50% is to be generated from renewable energy sources.

To achieve this target, CEB is planning to integrate 2,338 MW of solar and 765 MW of wind power to the national grid by 2030. This is challenging and at the same time creates many business opportunities for the private sector to invest in solar and wind power projects. It is paramount to meet low carbon goals, just as it is essential to provide reliable and low-cost energy to support economic growth. Hence, it is important for a developing country like SL to adopt a gradual process of phasing out fossil fuels, based on a scientific approach, rather than rebelling for an overnight green change.

SL seems to be progressing on that path, by promoting renewable energy and introducing liquid natural gas as gap fuel, with contributions of all stakeholders. So, with all this progression, how far have we come in the solar industry? How far behind are we in the global solar power generation arena? According to BP Statistical Review of World Energy (2021), solar electricity generation of the world is 2.7% of the total generation and that of SL is around 2.3% and growing. This is a sign that SL is on the path to a greener future.

But what lies ahead? Even though the SL solar industry has matured from its inception, up to now it primarily has been a passive one, where technology-wise local value-addition is minimal. All major equipment such as solar PV panels and inverters are imported and utilised locally, which is approximately 80% of project cost.

It is important that investments are made in areas like major component assembling or manufacturing, to enlarge the scope of local value addition. Sri Lanka has so far explored only mini-scale solar power generation, with specific attention to rooftop solar and smallscale ground-based solar.

Large-scale solar power generation facilities are not yet implemented. The feasibility of adding large-scale solar power plants to the national grids has to be studied further and new projects should be created. Furthermore, if we envision a country with high renewable penetration, steps have to be taken to upgrade our transmission networks to smart grids, to suit such scenario.

Apart from human technical capacitybuilding, SL has to explore new business models and investment options to make such large-scale solar power plants a reality. The Government, a utility, any authority, the private sector, or a citizen alone will not be able to make the future of the solar industry of SL brighter. It would only be a reality if all parties come forward and collaborate to do their part in setting strategic goals, research, capacity-building, investments, and utility perspectives. We are hopeful of such a brighter future

View the original article published on Ceylon Today Newspaper – Click Here

Eng. Rohan Seneviratne

Eng. Rohan Seneviratne

Additional General Manager

Ceylon Electricity Board

Eng. Lanka Perera

Eng. Lanka Perera

Electrical Engineer at Ceylon Electricity Board