Hydrogen Energy: A Rising Star in the Horizon

BY Eng (Dr) Manoj Ranaweera

Introduction:

In pursuit of carbon neutrality by 2050, as many nations pledged as a response to the Paris Agreement to combat climate change, decarbonization of the energy and the transport sector is a well-understood and shared interest across the globe. However, with the current level of anthropogenic CO2 emissions in the two sectors, the realistic achievement of carbon neutrality while serving the ever-growing energy demand requires dramatic low-carbon transformations. Promisingly, hydrogen technology appears as one of the potential enablers of this transition. Therefore, this article briefly elaborates on the potential of hydrogen technology concerning its current developments and future challenges in the global energy landscape as a futuristic green energy carrier.

The Global Hydrogen Landscape

Hydrogen is the lightest and the most abundant element in the universe. Nevertheless, molecular hydrogen exists only in trace amounts on the Earth's crust (about 0.0005% by volume in atmospheric air). Therefore, hydrogen must be extracted from where it exists in large quantities: in hydrocarbons and water.

Although hydrogen is a futuristic contributor to the energy and transport sectors, it is not a new substance to the industry at all. Oil refineries and chemical fertilizer production are the two largest consumers of hydrogen. In 2020, the global hydrogen production stood at approximately 90 Mt. Oil refineries have consumed nearly 42% of this while the chemical fertilizer industry has consumed nearly the balance[1].

At present, hydrogen production is mainly from natural gas and coal, that consumes nearly 6% of global natural gas production and 2% of the coal production. Thus, it releases approximately 830 million tons of carbon dioxides in each year[2]. Therefore, in the present scenario, hydrogen does not qualify as Green. Green hydrogen is the hydrogen produced from electrolyzing water using electricity generated from renewable sources such as solar and wind. Green hydrogen is the cleanest form of hydrogen. Even if natural gas or coal is used as the hydrogen source, if carbon sequestration is used to prevent carbon dioxide from releasing to the environment, such hydrogen is called blue hydrogen. However, the current hydrogen production yields, almost exclusively, gray hydrogen. Gray hydrogen is the hydrogen produced from fossil fuels without using carbon sequestration. Thus, it contributes to global warming.

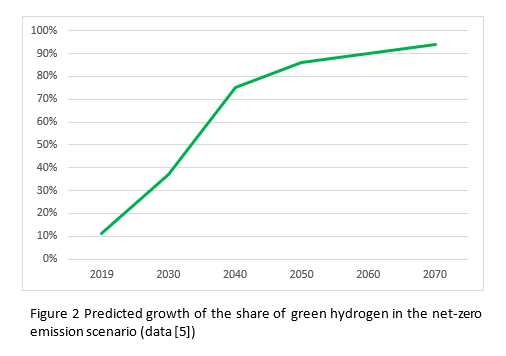

The global commitment towards achieving carbon neutrality is drifting the hydrogen production in a greener direction. Figure 1 depicts the dramatic boom in green hydrogen production from 2020 to 2026, as a measure of the installed electrolyzer capacity in 2020 and the planned projects to be commissioned by 2026. The boom continues to grow to attract a large number of investments, exceeding 500 billion USD, by 2030 for over 350 projects across the globe that include 28 projects on large-scale (over 1GW) green hydrogen production and 96 projects on hydrogen-powered mobility applications (trains, busses, cars, ships, and trucks)[4]. Figure 2 depicts the growth of the share of green hydrogen in the net-zero emission scenario. These data substantiate the potential growth of green hydrogen even beyond its current application domain of refineries and fertilizer production.

Hydrogen in the Energy and Transport Sectors

The role of hydrogen in decarbonizing economies was first emerged to gain wide popularity back in the 1970s when Prof John Bockris, a professor in chemistry, coined the term “hydrogen economy” in one of his speeches in General Motors (USA). However, hydrogen technology development did not get sufficient impetus until the concerns over climate change evolved as a hot topic.

Hydrogen is not an energy source rather a sustainable, cleaner, and abundant energy carrier. Hydrogen has a unique potential in decarbonizing the transport sector, which is a challenging sector to decarbonize. The high gravimetric energy density of hydrogen (nearly three times that of gasoline and six times that of coal) makes it an excellent choice for transport applications and energy storage. However, low volumetric energy density of hydrogen requires bigger pipes for transportation than for natural gas. Thus, it requires special attention when converting existing natural gas piping infrastructure to transport hydrogen, like in the case of the city of Leeds in the UK, where the city council plans to replace its existing natural gas supply lines to supply hydrogen by 2026 for domestic cooking applications. Nevertheless, the only challenge to converting existing gas lines to transport hydrogen extends far beyond the requirements of re-sizing. It requires addressing additional technical challenges such as hydrogen embrittlement of steel pipes and joints, preventing leakages of tiny hydrogen molecules, etc.

Fuel cell technology, which produces electricity from hydrogen while generating pure water as the only byproduct, is the enabling technology for the realization of the hydrogen economy. Although fuel cell systems gained a significant impetus in their developments over the last few decades due to the rising concerns over climate change mainly driven by burning fossil fuels, the technology is more than 200 years old making it as old as internal combustion engines.

There are different fuel cell types whose difference mainly lies in the type of electrolyte used. Among them, the proton exchange membrane fuel cell (PEMFC) is the most market-ready version. PEMFCs fall under the category of low-temperature fuel cells because their operating temperature is around 70 °C. However, at this low temperature, these require an expensive platinum catalyst to split hydrogen at the anode. Thus, the cost of the catalyst is nearly one-third of the total cost of the fuel cell stack. Requiring high-purity hydrogen (99.9%) is another challenge with PEMFCs. Despite the high cost and fuel purity challenges, PEMFC is already a commercial success. All commercial-level fuel cell applications in the transport sector, except for auxiliary power units in large trucks, are powered by PEMFC. Toyota, Hyundai, and Honda are the three leading automakers who produce hydrogen fuel cell cars on a commercial-scale namely, Toyota Mirai, Hyundai Nexo (previously, ix35), and Honda FCX Clarity (currently discontinued to introduce a newer version). In addition, Daimler (GLC F-CELL), Nissan (X-TRAIL FCV), and BMW (i Hydrogen NEXT) are some developments by other automakers but are not yet available commercially. Hydrogen fuel cell vehicle delivers the same convenience of refueling as a gasoline vehicle where a fuel cell vehicle can also be refueled (in a hydrogen filling station) within a time comparable to refueling a gasoline vehicle. While there are other transportation applications developed, such as fuel cell buses, trucks, and forklifts, the launch of the first-ever hydrogen-powered train in Germany in 2018 was a landmark project in the hydrogen technology deployment in the transport sector.

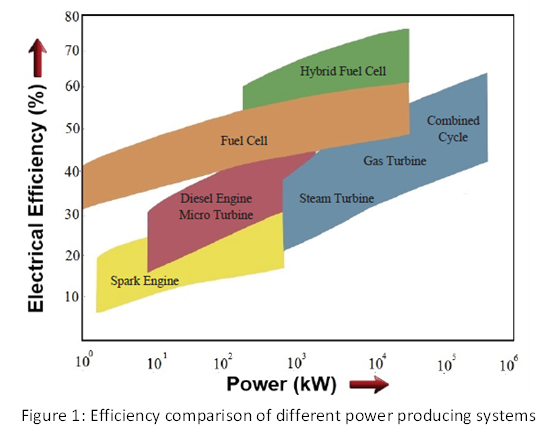

Solid oxide fuel cells (SOFCs), on the other hand, operate at relatively high temperatures (generally above 600 °C). Thus, a low-cost catalyst like Nickel is sufficient to oxidize hydrogen and the high operating temperature enables SOFCs to operate on a variety of hydrocarbons rather than only on pure hydrogen making it ideal in the early stage of the energy transition. Additionally, the high-temperature steam coming out from the fuel cell as a byproduct can be used in a bottoming Rankine cycle to produce more electricity improving the overall plant efficiency. Figure 3 shows a graphical comparison of the power-producing efficiencies of various technologies. As the diagram depicts, hybrid SOFC systems fuel cells with a bottoming steam cycle) deliver the highest efficiency of all types. However, premature degradation of the fuel cell stack is a major drawback the SOFC technology has yet to overcome before successfully commercializing the technology. Nevertheless, a US company called Bloom Energy has shown remarkable success in developing SOFC technology at a commercial scale using a proprietary electrolyte material that has been successfully generating on-site electricity in over 100 sites in the US for over the last 15 years. The customer base of Bloom Energy includes Amazon, Google, FedEx, and eBay.

Challenges and Opportunities:

The potential of hydrogen technology for a low-carbon economy is well-captured and interpreted by the business community, governments, and policymakers in different parts of the world. One of the leading global initiatives in hydrogen investments is the Hydrogen Council, formed in 2017 as a CEO-led global forum having a united long-term ambition: “for hydrogen to foster the lean energy transition for a better, more resilient future”. Its current membership exceeds 130 member companies from different sectors, including oil and gas. The European Parliament adopted a hydrogen policy and strategy in 2020 to accelerate the development of clean hydrogen, ensuring its role as a cornerstone of a climate-neutral energy system by 2050. Meanwhile, the national hydrogen strategy of Australia sets a vision for a clean, innovative, safe, and competitive hydrogen industry that benefits all Australians. The Energy Act 2005 of the US has a strong focus on developing hydrogen technologies and fuel cells for transportation, utility, industrial, commercial, and residential applications. Our neighboring India launched its National Hydrogen Mission in 2021 in parallel with the 25th Independence Day, with the aim of making India a green hydrogen hub. These are only a handful of evidence to show how business leaders and policymakers embrace the potential of hydrogen for future success. World Bank also outlines that green hydrogen paves the way for developing economies, with good renewable energy sources, to be least disrupted by oil price volatility and supply disruptions while increasing their energy security.

In parallel with the deployment of hydrogen vehicles, the hydrogen refueling infrastructure is also being developed in countries where fuel cell vehicles are available; as of mid-2021, there were about 450 hydrogen filling stations globally. Japan is leading the infrastructure development; it has 134 hydrogen filling stations. The next in the line are: Germany (90), the USA (46), South Korea (43), China (39), France (18), and the United Kingdom (11). Hydrogen refueling facility is a crucial infrastructure requirement in successfully deploying fuel cell vehicles. However, the two aspects yield a chicken and egg problem: investing in hydrogen infrastructure cannot be justified until fuel cell vehicles are deployed and the deployment of vehicles is impossible without the infrastructure. Thus, policy interventions are essential to promote hydrogen fuel cell vehicles.

Further to technical and economic challenges, hydrogen technology must pass the social acceptance test. So far, the perceived safety of hydrogen technology, especially of fuel cell vehicles, is at a stake. Requiring a high-pressure fuel storage tank (700 bar) due to the low density of hydrogen has ignited an undue safety concern over potential explosion of the fuel tank. Hydrogen leakages causing fires is another concern. However, since hydrogen is the lightest substance, it moves up faster in the sky in case of a leakage without accumulating in the ground level. It disperses much faster than gasoline limiting the possibility of spreading a fire. Therefore, hydrogen is safer than gasoline in many respects. What hydrogen face today is the similar safety concerns that LNG faced in its early days of introduction, which are now proven to be false fears. However, the colorlessness of hydrogen flame remains as a challenge in case of a fire.

The cost of green hydrogen is another limiting factor for the wide adaptability of the hydrogen energy. However, with the lowering cost of renewables, the cost of green hydrogen is also predicted to go down making it more affordable in the years to come. The three biggest consumers of hydrogen, as of 2020, are China (23.9 million tons/year), USA (11.3 million tons/year), and India (7.2 million tons/year)[7]. The cost of green hydrogen production in these three countries is predicted to go down from its values in 2020 approximately USD 4.52, 4.80, and 4.80, to USD 2.33, 2.1, and 2.1 in 2030, respectively[8].

In summary, hydrogen technology developments go in two parallel paths viz fuel cell technology development and green hydrogen extraction. Meanwhile, policy support and investment are also backing the aforesaid development pathways. Consequently, hydrogen will gradually emerge in the energy sector (including transportation) as a cleaner, sustainable, and affordable energy carrier for the future.

Reference:

- IEA, Global hydrogen demand by sector in the Net Zero Scenario, 2020-2030, IEA, Parishttps://www.iea.org/data-and-statistics/charts/global-hydrogen-demand-by-sector-in-the-net-zero-scenario-2020-2030

- IEA (2019), The Future of Hydrogen, IEA, Parishttps://www.iea.org/reports/the-future-of-hydrogen

- IEA, Global installed electrolyser capacity in 2020 and projects planned for commissioning, 2021-2026, IEA, Paris https://www.iea.org/data-and-statistics/charts/global-installed-electrolyser-capacity-in-2020-and-projects-planned-for-commissioning-2021-2026

- Hydrogen Council, Hydrogen Insights, July 2021.>

- IEA, Global hydrogen production in the Sustainable Development Scenario, 2019-2070, IEA, Paris https://www.iea.org/data-and-statistics/charts/global-hydrogen-production-in-the-sustainable-development-scenario-2019-2070

- Energy Sector Management Assistance Program. 2020. Green Hydrogen in Developing Countries. World Bank, Washington, DC.

- IREA, 2022, Geopolitics of the Energy Transformation: The Hydrogen Factor, International Renewable Energy Agency, Abu Dhabi.

- Statista, Production costs of green hydrogen worldwide by select country in 2020, with a forecast until 2050, Accessed on 4th April 2022, Available at: www.statista.com/statistics/1086695/green-hydrogen-cost-development-by-country

Eng. Eng (Dr) Manoj Ranaweera

Eng. Eng (Dr) Manoj Ranaweera

BSc. Eng (SL), PhD(UK)]

Senior Lecturer – Department of Mechanical Engineering

University of Moratuwa - Sri Lanka