| Why the Fascination With Coal Power When Better Alternatives Are Available? - by Dr. Anil Cabraal |

| |

|

| Source : allenergyforall.com/ |

| |

|

Many government officials say we must have coal power now and there are no other worthwhile alternatives. They say that coal is cheap; must build 1700 MW of coal power in Sampur now and add 1500 MW more coal in the South; and environmental concerns are a western luxury. Most recently, Dr. Kumar David in the Sunday Island of May 8th echoed these sentiments (“Sampur Coal Power is necessary: Are renewable energy evangelicals doing themselves a disservice?”). Let me address these and other concerns and offer reasonable alternatives.

Inaccuracy 1: Sri Lanka electricity demand is forecasted to grow very fast; but reality is that there are cost-effective and practical ways to reduce electricity demand growth without hurting the economy.

CEB forecast of electricity demand shows it grows rapidly in the next 5-10 years. CEB has acknowledged that in the past their forecasts have overestimated demand growth. CEB has shown that energy efficient Demand-side Management (DSM) measures can reduce electricity needed by about 20% (in 2025) below their forecast. CEB found that DSM measures could eliminate the need to build six new coal plants equal to twice the capacity at Norochchalai. The regulator, PUCSL has requested CEB to redo its expansion plan taking DSM into account. I understand that the Sustainable Energy Authority (SLSEA), has submitted a DSM action plan to a Presidential Task Force. This is encouraging.

Efficiency improvements can be done faster and it is less costly than building large power plants. Most immediately by using LED lamps to replace CFL and other less efficient lamps, could significantly reduce electricity demand during the peak hours of 6:30 – 10:30pm. Another area is reducing power transmission and distribution losses. CEB loses nearly 11% of the electricity supplied while LECO loses less than 5%. So, there is room to save more electricity by reducing transmission and distribution losses.

Inaccuracy 2: The 500 MW coal power plant at Sampur must be constructed without further delay to avoid power shortage in 2018; but the reality is that a coal plant cannot be built that fast.

If indeed a power crisis is likely in 2018, then coal plant in Sampur is not the solution. It will take much longer to build the power plant and transmission line. In the interim, more expensive emergency generators could be required. A more realistic solution is building a Liquefied Natural Gas (LNG)-fired combined cycle gas turbine (CCGT) plant on the west coast. It can be built faster than a comparably sized coal plant and its capital cost is less. The first gas turbine stage of a CCGT plant can be operational in 1.5-2 years while the second steam power stage is being built. I was encouraged to read that Min. Siyambalapitiya has voiced support for an LNG CCGT plant in Kerawalapitiya. CEB had already identified Colombo North Port as a suitable site for a LNG terminal and Kerawalapitiya for building a gas-fired CCGT.

LNG is a logical transition fuel to using our own natural gas.

Mr. Saliya Wickremasuriya (DG Petroleum Resources Development Secretariat, PRDS), at a recent seminar said that Sri Lanka has commercially exploitable amounts of natural gas. The main barriers to using our own natural gas is the uncertain demand and lack of infrastructure to deliver the gas. He urged that the LNG option be adopted in the near term to create the gas demand. It would catalyze the building of infrastructure to extract and deliver domestic natural gas. This would permit the gradual transition from imported LNG to domestic natural gas over the course of several years. He emphasized that this is the perfect time to sign up for LNG contracts as gas price is low. There is spare industrial capacity for building the LNG terminal and regasification facilities. He estimates these facilities can be set up in six months from contract signing. There is enough demand to justify an LNG terminal on the west coast to supply gas to the existing three CCGT plants plus new gas power plants. Moreover, signing a long term government-to-government LNG supply contract can bring price predictability to gas compared to buying coal or oil on shorter term contracts.

Inaccuracy 3: Coal power is cheap; but the reality is that it is not.

Electricity from the Sampur coal power plant will be expensive even on a purely financial basis (without considering environmental costs). If so, how did CEB justify adding only coal power and no LNG power plants in their least cost plan? Good question.

The reasons are:

|

| |

| |

CEB ignored the cost of a transmission line to bring power from Sampur to the western province, and the cost of a coal unloading jetty at Sampur. Costs will rise further as the Central Environmental Authority has required additional changes to the cooling water discharge arrangements for the Sampur power plant. |

| |

|

| |

Coal price was based on today’s low cost of coal, while LNG price was from 2008/09 when LNG price was higher. |

| |

|

| |

Sampur coal power plant cost is assumed to be less than Norochchalai coal plant. Given the troubles at the Norochchalai plant, I wonder what might happen with an even cheaper plant. |

| |

|

| |

Gas CCGT plant cost was assumed to be higher than a diesel CCGT plant cost even though both are essentially the same technology. |

| |

|

| |

CCGT cost was inflated by a cost share for an LNG receiving terminal and regasification facility. Yes, this is a real costs and must be taken into account. But the better way to account for this cost is to amortize it into the cost of gas. |

| |

|

| |

Rupee depreciation was ignored in the analysis. Yes, that effects both coal and LNG fuel price in the future. But, LNG plants are more energy efficient and so required less fuel to be purchased per kWh. |

| |

|

|

|

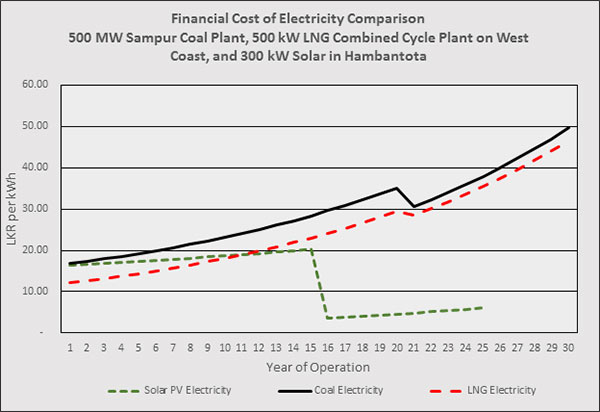

I compared the electricity cost from a coal plant in Sampur, a similarly sized west coast gas CCGT and a solar plant in Hambantota over the life of the power plants (see assumptions in endnote). I did the analysis in Sri Lankan rupees to assess the impact of rupee depreciation. The results are enlightening as shown in Figure 1. It shows LNG electricity is least cost today, followed by solar and coal is more expensive. Coal and LNG electricity costs rise over time, but solar cost is relatively unchanged as there is no fuel. There is drop in cost once the loans are paid off. The issue of variability of solar power is discussed later.

Cost of financing renewable energy or perhaps even LNG, could be further reduced by tapping into concessional financing from sources such as the Green Climate Fund.

Inaccuracy 4: Environmental cost of a coal power is insignificant; but the reality is that it imposes a real cost on people, environment and economy.

The CEB plan assumes environmental damage is EUR 0.001 per kWh (Rs. 0.166 per kWh). A 2014 study by the Sri Lanka Carbon Fund (Ministry of Environment), estimated that the damage cost from coal power is USD 0.117 per kWh (Rs. 15 per kWh using 2014 exchange rate) – 100 times greater than CEB assumption. In contrast the study estimated that gas CCGT had an environmental damage cost of USD 0.0048 per kWh. The Carbon Fund study considered only cost of air emissions and not the impact of discharging hot water and other liquid effluents into the sea or bays.

CEB’s own expansion planning showed that if environmental damage cost was more than EUR 0.048 per kWh, LNG would be the lower cost option and not coal.

|

| |

|

| Figure 1 Financial Cost of Electricity from Coal, LNG and Solar (author calculations) |

| |

|

Inaccuracy 5: We can ignore environmental costs now and clean up once we are an upper income country – environmental concern is a western luxury; in reality this is a dangerously wrong argument and especially unfair to those living in affected areas.

China, India and other coal-use intensive countries are paying a price in terms of environmental degradation and health impacts. The cost of pollution in China is estimated at 6.5% of GDP last year. India lost USD 80 billion due to environmental pollution – about 6% of its GDP. Of course, not all the environmental damage cost is due to coal burning. These countries are taking remedial measures. China has suspended new coal plant approvals. A Deutsche Bank report stated solar power in India could surpass investment in coal by 2019-20.

Do we want to risk making our exports less competitive?

More coal power could also have a detrimental impact on exports. With the signing of the Paris Climate Change Agreement, more countries may impose carbon taxes to limit carbon emissions. Some countries that impose carbon taxes may charge countervailing duties on imports based on carbon intensity of exporting countries, and GATT rules may permit it, in order to level the playing field.

Inaccuracy 5: Potential for renewable energy in Sri Lanka is limited; in reality potential is huge.

In 2015, non-conventional renewable energy provided enough electricity to meet the needs of 2 million households (1466 GWh sold to CEB plus another 28 GWh through solar net metering), according to CEB. The potential is far greater:

|

| |

| Renewable Energy |

Potential |

| |

|

| Wind: 124 MW today |

The Government is discussing with ADB about financing a 100 MW wind farm in Mannar. A joint UNDP/World Bank team assessed a total wind power potential of 1,800 MW stretching over Southern coastal belt, Southeast lowlands, Puttalam-Kalpitiya bay and Mannar-Jaffna area. |

| |

|

| Solar: 21 MW today |

Three 10 MW solar plants are under construction in Hambantota. We have not even begun to tap our solar potential (as a theoretical indicator consider that solar on 100-140 km2 area can generate enough electricity to supply our annual requirements in 2014). These need not take up valuable land – many can be roof mounted, as is being done today. Floating solar plants are becoming commercially available. For example, 300 MW of floating solar installed on 20% of the water surface of Victoria reservoir could supply about 450 GWh/year of electricity. Water evaporation would also reduce. |

| |

|

| Biomass: 20 MW today |

The CEB has signed Power Purchase Agreements for another 65 MW of projects. Electricity production from biomass is challenging as availability of land for growing fuelwood crops may be limited. However, we should consider using unproductive plantation lands for growing fuelwood. We have also not even begun to tap the potential for high yielding fuelwood crops: Fuelwood species like Gliricidia yield 40 tons of fuelwood per hectare per year while some species of bamboo could yield 100 tons per hectare. An SLSEA study is underway to remove barriers to biomass plantation, increase use of biomass for energy generation, and promote bio-energy technologies. |

| |

|

| Small Hydropower: 315 MW today |

CEB has signed power purchase agreements for another 177 MW. If all these plants are built, total electricity from smaller hydro power plants could reach 1,400 GWh/year. |

| |

|

|

| |

|

If Sri Lanka is seriously committed to benefiting from its own natural resources, we have to invest in technologies that work best with renewable energy. Variability of solar and wind power is a valid concern. Solar power is available only during the daytime and varies with sun conditions. Wind power varies with wind speed. The variability can be managed by using solar/wind with complementary power plants or storage. They could be energy storage (hydro storage, or battery storage which may be cost effective in 5 years); flexible generators (CCGT, hydro and diesels); or active demand management. Coal power is unsuited to working with large amounts of intermittent generation as coal plants have difficulty responding quickly to load changes. Therefore, the more dependent we become on coal power, the less we will be able to use our renewable energy resources.

Help is available to switch from coal to solar energy. The World Bank Group Scaling Solar Program is a “one-stop shop” for smaller countries that want to attract private investors to build large-scale solar plants. Scaling Solar offers technical assistance, document templates, pre-approved financing, insurance products, and guarantees. Under the program, a country can assess a project, manage a competitive tender, build a plant, and start generating cheap, sustainable solar power within two years. For more information, contact the IFC Office in Colombo (011 540 0100), or visit the web site, Unlocking Low-Cost, Large-Scale Solar Power.

In conclusion, coal power when compared to LNG power is more capital intensive, and takes longer to build. It has higher cost electricity. It is more polluting. It limits the use of our renewable energy. So why are we determined to invest in coal rather than LNG power? LNG is the perfect bridging fuel to move to use our natural gas, and it is good match to renewable energy. I appeal to our decision makers to carefully assess the alternatives before committing the nation to a coal-intensive future.

Author: Dr. Anil Cabraal, Board Member, Energy Forum and Retired Lead Energy Specialist, World Bank, Washington DC

|

|

| i CEB, Long Term Generation Expansion Plan 2015-34 |

| ii Principal assumptions: Rupee depreciation 5.632%/annum) against USD (Central Bank historical data), Rupee Interest rate 11.75%, 20-year loan for coal and LNG plants and 15 years for solar, 30% equity, 18% return on equity, Coal and LNG plants at 80% PLF, Solar 19.6% PLF. Solar output is assumed to degrade 1% per year. Installed solar cost from India CERC Benchmark (USD 750/kW) increased by 50%. LNG fuel price based on Qatar LNG contract price with India, plus margin for terminal and regasification facility. Other data principally from LTGEP. |

| iii See Green Climate Fund |

| iv See Sri Lanka Carbon Fund, Natural Gas – New Energy Resource in Sri Lanka, report to Petroleum Resources Development Secretariat, 15 October 2014. |

| v CNBC, Pollution crisis is choking the Chinese economy. |

| vi Financial Times, Environmental damage costs India $80bn a year. |

| vii PVTECH, India solar power investment could surpass coal by 2019-20 – Deutsche Bank. |

| viii World Trade Organization notes that GATT Article II.2(a) provides for the “possibility of imposing at any time on the importation of any product: A charge equivalent to an internal tax in respect of the like domestic product or in respect of an article from which the imported product has been manufactured or produced in whole or in part”. |

| ix ESMAP. Greenhouse Gas Mitigation Options in the Sri Lanka Power Sector, Joint UNDP/World Bank Energy Sector Management Assistance Programme |

| x GEF, Promoting Sustainable Biomass Energy Production and Modern Bio-Energy Technologies. |

| xi IFC, Scaling Solar, For more information |

|

|

| |

| "All Council Members can be contacted via email or phone by first login as a member to MyIESL and then acceding the Council Directory. It is also possible to communicate your concerns from anywhere in the world by posting them to the Forum - Meet The President and Council from the Forum page" |

| |

|